In a nutshell

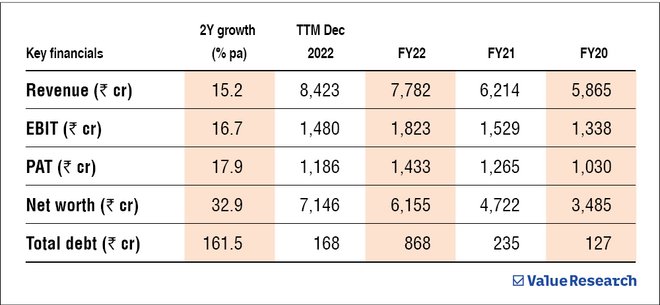

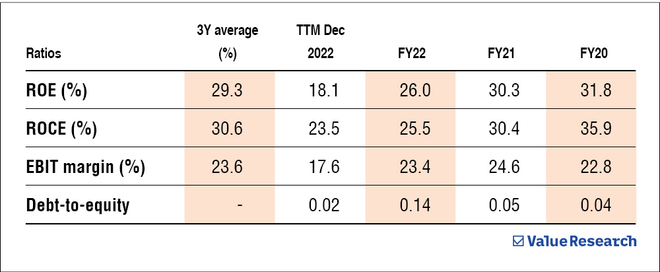

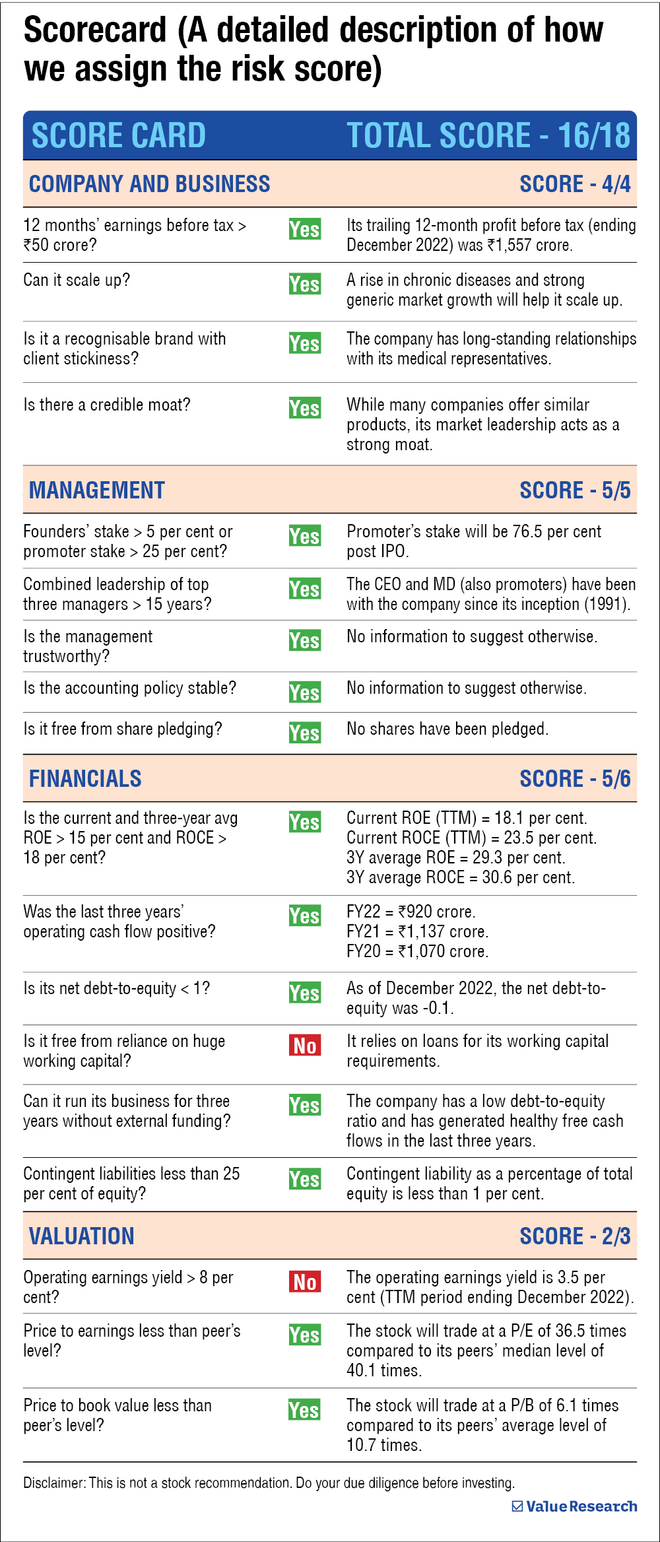

Mankind Pharma's three-year average ROE and ROCE are 29.3 and 30.6 per cent, respectively. It reported a higher net profit margin than most of its peers. Moreover, it also had healthy operating cash flows in the last three financial years.

About the company

Mankind Pharma is the fourth largest Indian pharmaceutical company in terms of domestic sales and generates most of its revenue from India (98 per cent in FY22). It makes drugs across several therapeutic areas, such as antibiotics, gastrointestinal, etc., and has a strong presence in the consumer healthcare segment (condoms, pregnancy detection, emergency contraceptives, etc.).

Strengths

in terms of market share in male condoms (30 per cent), pregnancy detection (80 per cent) and emergency contraception (62 per cent). It is also among the top 10 players in each therapeutic category of its pharma segment.

Weaknesses

With the pharma segment under intense scrutiny for quality control, any slip in quality might have a drastic impact on the company's future.

Disclaimer: This is not a stock recommendation. Do your due diligence before investing.