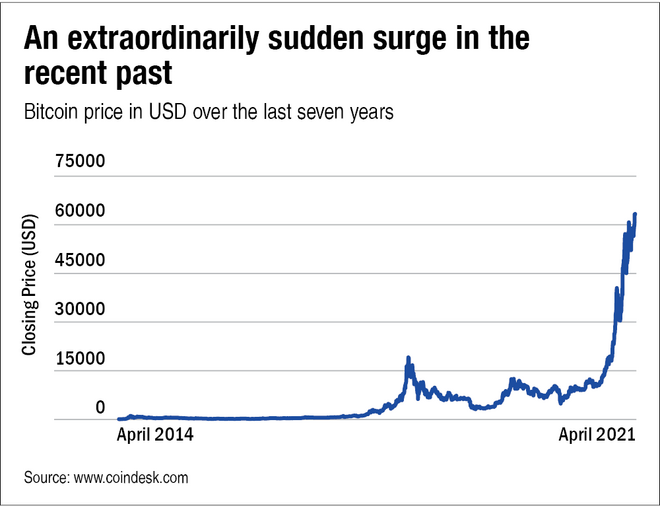

The Bitcoin craze has resurfaced once again. It is resembling a zombie, which keeps crawling back from its grave, despite multiple attempts made by the governments across the world and reputed investors to kill it. In this never-ending saga, the latest news was that the price of a Bitcoin touched its lifetime high of $64,747. Its price has almost quadrupled in the calendar year 2020 and has gone up by another 120 per cent in the calendar year 2021.

However, before you decide to jump on the cryptocurrency bandwagon (Bitcoin is the most prominent one among multiple cryptocurrencies), it's important for you to first get a clear understanding of what a currency is. Then only you can reach a meaningful conclusion about investing in this latest craze.

Historical context

During historical times, the barter system was the predominant method of conducting transactions. For example, under this system, a farmer exchanged his grains for meat with a shepherd . But the problem in this system was that the transaction could take place only if both the farmer and the shepherd simultaneously wanted each other's goods. This problem, known as the double coincidence of wants, was solved by the invention of currency.

Currency, in its simplest form, refers to anything that can be used as a medium of exchange. Although things like cigarettes, seashells, ivory and even beads were used as currency many times, in order to qualify as currency, an object needs to have certain characteristics, the main one being a store of value. And any item can be said to be valuable as long as it is useful in some manner. Even in history, when the shepherd exchanged his goats for grain with a farmer , both, the goats and the grains, were valuable.

What is Bitcoin?

In layman's terms, it is a software-generated reward point - quite similar to what people get while playing video games. However, the difference is that Bitcoins are given as a prize only to those who can solve mathematical problems, which keep increasing in difficulty as the number of Bitcoins generated increases.

Nowadays, the difficulty level is so high that no person can solve it without using powerful computers. These players/competitors who generate Bitcoins (called miners) are mainly those who can afford to purchase a vast network of computing resources, which are then continuously put to work in an attempt to solve the next big problem. Once the problem is solved, they receive Bitcoins for their effort. Sounds puzzling? Don't worry you are not alone.

Here comes an interesting question - why would anyone pay money for these reward points? Though no one knows the answer to this question, what can definitely be said is that naive hope plays a major role. It's the hope that somebody else (who is just as naive if not more) would be willing to pay a higher price in the future.

What's the value behind the currency?

By now, it is probably clear that under this framework, cryptocurrencies have no intrinsic value. A cryptocurrency doesn't give fruits like a tree, milk like a cow, interest like money or rent like a house. It cannot be eaten, seen or even experienced. It gives absolutely nothing and the only reason why it could have any value in the future is if somebody else believes so.

Comparison with gold

Cryptocurrency believers are quick to compare it with gold on two grounds - first, its limited supply (only 21 million Bitcoins can ever be created) and second, its lack of any returns. But what they fail to understand is that gold does have an intrinsic value. It has an alluring shine which does not fade away with time (that's why jewellery is made out of it) and it is also used for industrial purposes (since it is a reliable conductor of electricity).

Their next argument is that most of the gold purchases today are done for investment purposes and not with the intention of being used for jewellery/industrial purposes. But that still doesn't take away the fact that gold could be, theoretically, used for their intrinsic purposes. Without such a purpose, gold would be like just any other rare-to-find metal (Ex. francium) which has no use in our daily life.

Then what are Bitcoins used for?

Bitcoins do have some advantages over the conventional currency and gold. These currencies could be used to avoid paying commissions while trading in the forex markets. Further, if you live in countries that have extremely high levels of inflation (such as Zimbabwe, Venezuela etc.), Bitcoin might be a more reliable store of value than the local currency. But thankfully, Indian investors don't have to worry about these considerations.

Also, it can be accessed from anywhere in the world, reducing the need to carry it physically. Since it is not controlled by any single entity, it is not easily traceable, and therefore, cannot be demonetised. These features may be useful for a small fraction of the population who would like to use it for illegal purposes, but for the vast majority of the population i.e honest, tax-paying and hard-working individuals, the risks of a sudden precipitous decline in the value of a cryptocurrency far outweigh any benefit that this form of the currency promises to give.

So, the comparison with gold is extremely misguided. Being devoid of any benefit, Bitcoin is about as useful as real estate on the moon (and yes, people are actually paying money for it). Sure, it has many properties that are characteristic of money - it is divisible (can be exchanged in smaller quantities), fungible (individual units are interchangeable), durable (can withstand repeated use), portable (can be easily carried), scarce (limited supply) and cannot be counterfeited. But the moot point is so what?

Why is it going up?

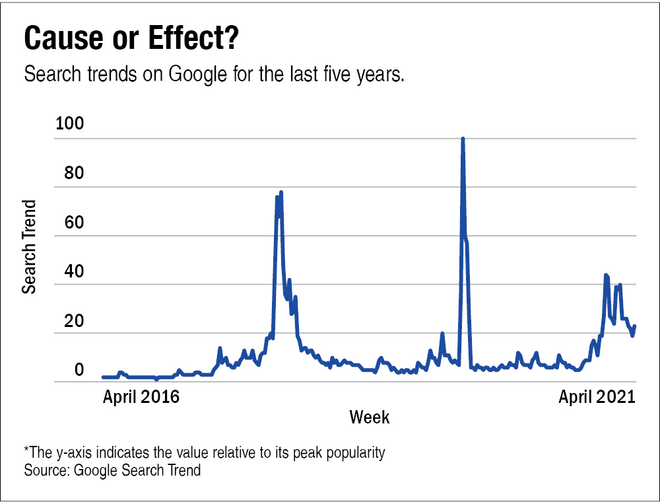

Again, the short answer is no one knows. There are many theories, from complex ones, such as expansionary monetary policy, to simple things such as the investor frenzy (as reflected by the number of Google searches).

The financial press generally talks about Bitcoin only when it goes up. So, the ugly downside is not widely publicised. Had an investor purchased it during its previous peak in late 2017, she would have been left with only 20 per cent of her value a year after.

What should investors do?

Steer clear of it. The fact that the currency has lost 80 per cent of its value in the past should make it amply clear that it doesn't qualify as an investment, let alone as a currency. Investors need to stop worrying about all the possible amounts of gains that they could have made if they had purchased Bitcoins. It is an illusion that doesn't deserve to be given a second thought. When in doubt, it pays to remember what Benjamin Graham (Warren Buffett's guru) wrote about investing, "It is an operation which promises safety of principal and satisfactory return." Investing in cryptocurrencies offers neither.