The headlines present it as a big deal, and it definitely is. Vanguard funds are coming to India, brought in by Navi, a new fund company set up by Sachin Bansal, who was one of the founders of Flipkart. The headlines are a bit of an exaggeration and overstate what exactly is happening. Vanguard is not coming to India in the sense that foreign companies usually come to India and either acquire or set up businesses here. What is happening is that Mr Bansal's Navi will run a mutual fund named Navi Total US Stock Market which will simply front-end one of Vanguard's US-based funds, the Vanguard Total Stock Market Index Fund. You will invest in Navi's Indian fund, and it will pool all investors' money and invest in the US fund on their behalf. There's nothing new in this - there are already a large number of Indian funds which route investments to various foreign funds, with the oldest such fund being 16 years old.

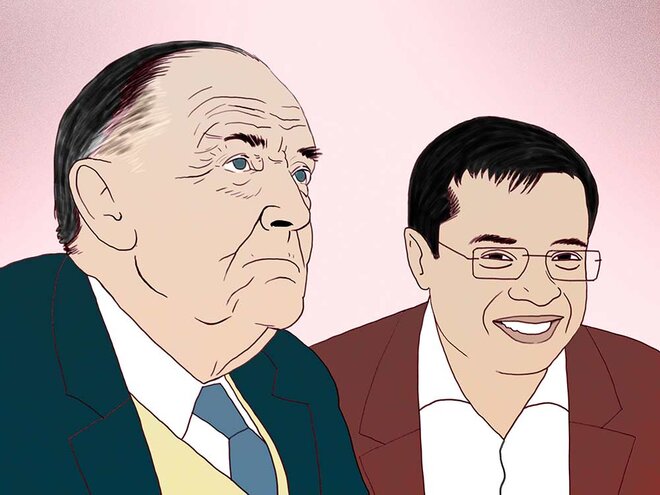

What is new is Vanguard. Vanguard is the fund company founded by John Bogle, who, for practical purposes, invented the idea of low-cost passive investing through funds that simply replicate a stock index. John Bogle famously said, "In investing, you get what you don't pay for." After a quarter-century of working in a mutual fund, Bogle started Vanguard in 1976. It was the first mutual fund in the world to make low-cost index investing available to individuals. Vanguard's funds charge famously minuscule amounts of money from investors as expenses. The Vanguard fund, the one Navi will front-end, has expenses of 0.03 per cent per annum.

Most actively managed Indian equity funds charge 1 per cent or more. However, the Vanguard expense ratio is not unusual in India - many homegrown passive funds charge around this much. What is truly distinctive about Vanguard is something else. John Bogle founded Vanguard as not a normal business owned by him and his family but as a non-profit! In an unusual structure, the company is owned by the mutual funds it runs, which in turn are owned by the investors who have put money into them. There is no other owner. In Indian terminology, it's essentially (though not technically) a co-operative. All these years, the profits it would have made were it a normal Wall Street company have actually gone to investors as higher returns.

All those investors are richer, but Bogle was not. At the time of his death in 2019, he was worth less than $100 million, which is a tiny fraction of others who have founded far smaller (and far less impactful) businesses. Bogle once said in an interview that he was proud that he wasn't a billionaire. It's hard to believe that such a man could have been part of the round-the-clock 360-degree cutthroat attitude the financial world has towards everything.

The unusual structure of Vanguard does point to the fact that if a fund company sticks only to ultra-low-cost passive funds, then it would be hard for it to function as a profitable business. In India, where funds need hard selling by well-compensated intermediaries, such a fund company will find the going tough. Of course, given Mr Bansal's business experience, it's possible that the idea of building a profitable business is not part of his plan, but nonetheless, this will be an interesting experiment. Low-cost passive investing hasn't yet taken off in India. If you look at the asset base of such funds, it looks large and rapidly growing but that's almost entirely because the EPFO mandatorily invests a percentage of its inflows in this manner. Indian equity investors actively choosing passive funds in a significant number is something that's still in the future. How far into the future, it's hard to tell.