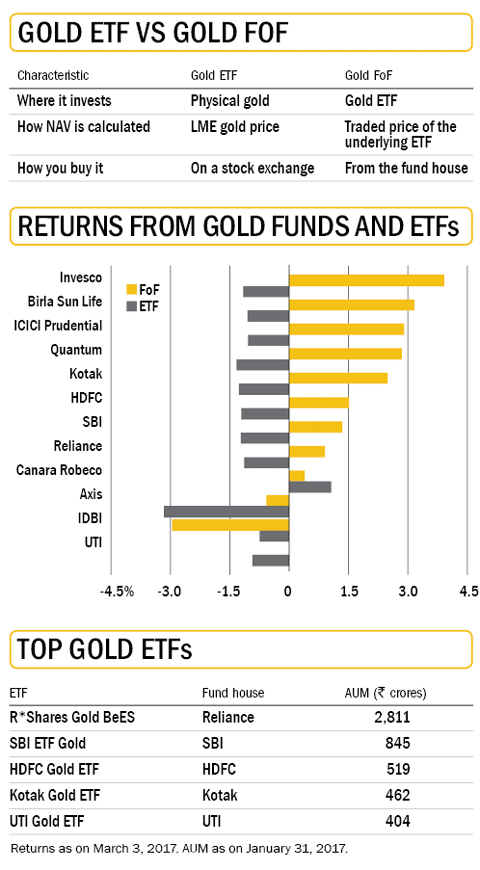

Using the mutual fund route, you can invest in gold through a gold fund (which is essentially a fund of fund, or FoF) or through a gold exchange-traded fund (ETF). All gold ETFs simply buy and hold gold and hence are supposed to deliver broadly similar returns as gold itself. Gold funds buy and hold gold ETFs and hence are also expected to merely follow the returns of gold. However, our analysis of gold FoFs reveals extreme variation in their returns, with the best fund (Invesco India Gold Fund) delivering 4 per cent and the worst (IDBI Gold Fund) giving about -3 per cent over the past year. Gold FoFs have also collectively outperformed their underlying asset - gold ETFs - adding to the puzzle. So what's actually happening?

Are gold FoFs better than ETFs?

ETF NAVs are based on the price of gold as published by the London Bullion Market Association converted to rupees (adjusting for customs duties and transport costs). On the other hand, the NAVs of gold FoFs are computed using the traded prices of their underlying ETFs on the stock exchanges. In other words, if an ETF trades higher or lower than its NAV in the market, the corresponding gold FoF does better or worse. But since ETF returns are calculated on the NAV, and not traded price, the impact seen on gold FoFs vanishes in the case of ETFs. But if you sell the ETF, you will receive the traded price and hence your returns will be more or less the same as those from an FoF. So, the difference in returns from an ETF and its FoF is just an illusion.

How to select a gold fund

A set of random factors can cause the traded prices of gold ETFs to diverge significantly from their NAVs, particularly in the case of small funds. This in turn causes gold FoFs holding them to also do significantly better or worse. This is apparent when you observe the past year's underperformers and outperformers; they were relatively small funds. It is impossible to predict these random events and thus to say conclusively that you should opt for one fund or another. However, you are better off sticking to the FoFs which hold large ETFs as they are less vulnerable to these events.

Moral of the story

Investing in gold is problematic, even through the mutual fund route as we show above. We have always maintained that you should not invest in gold and we reiterate it here. Why end up with returns of between 4 and -2 per cent in gold, when equity multicap funds have returned 27 per cent over the same period and 16 per cent over the past five years?

This column appeared in the April 2017 Issue of Mutual Fund Insight.